HSBC to detect savings of $ 1.5 billion while Elhedery’s restructuring triggers

Unlock free Digest editor

Roula Khalaf, editor of FT, chooses her favorite story in this weekly newsletter.

HSBC is preparing to discover $ 1.5 billion a year’s costs from the radical overhaul of the bank’s executive director Georges Elhedery.

The biggest lender in Europe will first present the figures on Wednesday, February 19, when Elhedery gives investors year -round results.

It is expected to report $ 1.5 billion savings from changes after one -time costs, according to two people familiar with the issue.

HSBC refused to comment.

Elhedery is in October, weeks after Taking a reinsTo reduce multiplication and help eliminate costs from an organization that has long had a reputation of bureaucracy.

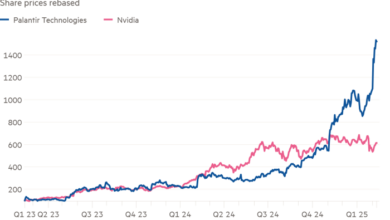

Executive director said the plans would result in a “simpler, more dynamic and agile organization.” The bank shares increased 30 percent of the announcement.

Elhedery’s central plans are the changes in the way London’s group is organized. It now has individual units dedicated to its two basic markets of the UK and Hong Kong, one unit focused on corporate and institutional banking and the other for international wealth and premiere banking.

The reorganization meant connecting commercial and investment banks, two of the three HSBC divisions to its old structure.

The combination allowed them Elhedery to reduce the number of bankers who double in different geographical areas-in the higher ranks and most of the belts so far comes from release. Reduced the number of the best managers by about half.

On Wednesday, the HSBC is also preparing to quantify savings expected from Elhedery’s decision to withdraw from some non-olive markets, which has put two people at about $ 1.5 billion.

HSBC announced in January that he would withdraw from the key parts of his business of investment banking in the UK, Europe and America, which he captured many employees in these companies outside the guards. He also decided Turn off your payments App Zing just one year after his launch.

The bank acted quickly to launch Elhedery’s plan into action, but he still deals with what to do with his business in Mexico, people told the discussions.

HSBC has examined a significant reduction in its Mexican business as part of a wider overview of its non-olive retail operations, the Financial Times has previously reported.

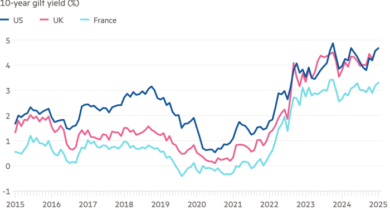

The bank is under pressure to control the costs as a period of interest rates – which increased the bank profit – near the end.

Its net interest margin, a key measure to borrow profitability, fell in the third quarter of 2024. Its costs increased by 2 percent, in part because of inflation.

In recent years, in the main issue of HSBC, it has remained stubbornly high despite the efforts of Elhedery’s predecessor to overthrow the bank.

Former Noel Quinn CEO has previously committed to reducing full jobs by 200,000 by the end of 2023.