Markets upbeat as Trump returns to White House Reuters

By Suzanne McGee and Lewis (JO:) Krauskopf

NEW YORK (Reuters) – Investors welcomed Donald Trump’s second inauguration, expecting a pro-business agenda, while remaining wary of his protectionist trade policies, particularly his stance on tariffs.

During Trump’s speech, stock futures rose, with index contracts trading up between 0.4% and 0.5%.

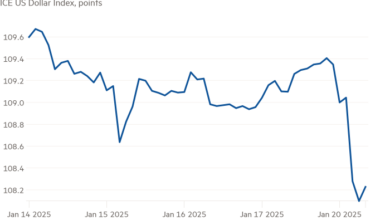

The dollar weakened ahead of the inauguration, as the Trump administration signaled that no new tariffs would be imposed on the new president’s first day in office.

“While we suspect a fair degree of volatility will continue for some time, ultimately we expect his first year in office to coincide with further strengthening of the US dollar and US equities,” said James Reilly, senior market economist at Capital Economics. .

Trump takes office with an ambitious agenda that includes trade reform, a crackdown on immigration, tax cuts and loosening cryptocurrency regulations. Investment managers are adjusting portfolios by asset class, watching his inaugural speech for signals that could trigger short-term market moves.

“Uncertainty remains the key word, with everyone poised for answers to questions like whether the threat of tariffs will become a reality or just a negotiating ploy on day one,” Sam Stovall, chief market strategist at CFRA Research, said ahead of the inauguration.

But many are hoping for a relatively muted response to the new president’s initial comments and actions.

“Trump’s bark may be worse than Trump’s bite initially,” said Michael Arone, chief investment officer at State Street (NYSE:) Global Advisors. He expects the timing and impact of Trump’s most significant policy changes to unfold over a longer period of time.

Still, there is a possibility that Trump’s tariff plans could further stoke inflation fears that would pressure bond and stock prices, while efforts to tighten immigration controls could also resonate with those markets. Moves to ease regulation lifted bank stocks and soared cryptocurrencies.

As they reported a sharp rise in profits, Wall Street executives told investors that the new US administration would be good for business and good for banks.

“Investors were excited about the possible loosening of regulations and possible reductions in corporate taxes,” Stovall said.

The S&P 500’s post-election rally cooled to a 2.7% gain, after falling in early January on inflation fears.

Trump plans to begin his presidency with a wave of executive orders targeting key policy areas, including immigration and energy. During his speech, he offered a taste of that, including promises to declare a national energy emergency and open the door to energy research and development and impose tariffs.

“We will impose tariffs and tax foreign countries to enrich our own citizens,” Trump said.

During his inaugural address, Trump also announced the creation of an “External Revenue Service” to collect those tariffs from foreign trading partners.

The cryptocurrency industry expects Trump to fulfill his campaign promises to be a “crypto president” by creating a federal bitcoin stockpile, expanding access to banks and creating a crypto council, Reuters previously reported.

During Trump’s speech, the price of bitcoin fell slightly to $102,756 from an overnight high of over $107,000. The president did not make any specific statements regarding cryptocurrency in his inaugural address.

During the first year of Trump’s first administration, the S&P 500 rose 19.4%, after rising 5% in his first 100 days in the Oval Office. Throughout Trump’s first term, the S&P 500 has risen nearly 68%, but markets have seen bouts of volatility stemming in part from Trump’s trade war with China.

After Trump’s last inaugural address, in January 2017, the S&P 500 ended up 0.3% for the day. US stock and bond markets are closed on Monday for Martin Luther King Jr. Day, so most trading reactions may not be seen until Tuesday.